Whether you’re formatting an internal drive, external drive, or

removable drive, Windows gives you the choice of using three different

file systems: NTFS, FAT32, and exFAT. The Format dialog in Windows

doesn’t explain the difference, so we will.

A file system

provides a way of organizing a drive. It specifies how data is stored

on the drive and what types of information can be attached to

files—filenames, permissions, and other attributes. Windows supports

three different file systems. NTFS is the most modern file system.

Windows uses NTFS for its system drive and, by default, for most

non-removable drives. FAT32 is an older file system that’s not as

efficient as NTFS and doesn’t support as big a feature set, but does

offer greater compatibility with other operating systems. exFAT is a

modern replacement for FAT32—and more devices and operating systems

support it than NTFS—but it’s not nearly as widespread as FAT32.

NT File System (NTFS)

NTFS is the modern file system Windows likes to use by default. When

you install Windows, it formats your system drive with the NTFS file

system. NTFS has file size and partition size limits that are so

theoretically huge you won’t run up against them. NTFS first appeared in

consumer versions of Windows with Windows XP, though it originally

debuted with Windows NT.

NTFS is packed with modern features not available to FAT32 and exFAT.

NTFS supports file permissions for security, a change journal that can

help quickly recover errors if your computer crashes, shadow copies for

backups, encryption, disk quota limits, hard links, and various other

features. Many of these are crucial for an operating system

drive—especially file permissions.

Your Windows system partition must be NTFS. If you have a secondary

drive alongside Windows and you plan on installing programs to it, you

should probably go ahead and make it NTFS, too. And, if you have any

drives where compatibility isn’t really an issue—because you know you’ll

just be using them on Windows systems—go ahead and choose NTFS.

Despite its advantages, where NTFS lacks is compatibility. It’ll work

with all recent versions of Windows—all the way back to Windows XP—but

it has limited compatibility with other operating systems. By default,

Mac OS X can only read NTFS drives, not write to them.

Some Linux distributions may enable NTFS-writing support, but some may

be read-only. None of Sony’s PlayStation consoles support NTFS. Even

Microsoft’s own Xbox 360 can’t read NTFS drives, although the new Xbox

One can. Other devices are even less likely to support NTFS.

Compatibility: Works with all versions of Windows, but

read-only with Mac by default, and may be read-only by default with some

Linux distributions. Other devices—with the exception of Microsoft’s

Xbox One—probably won’t support NTFS.

Limits: No realistic file-size or partition size limits.

Ideal Use: Use it for your Windows system drive and other internal drives that will just be used with Windows.

File Allocation Table 32 (FAT32)

FAT32 is the oldest of the three file systems available to Windows.

It was introduced all the way back in Windows 95 to replace the older

FAT16 file system used in MS-DOS and Windows 3.

The FAT32 file system’s age has advantages and disadvantages. The big

advantages is that because it’s so old, FAT32 is the de-facto standard.

Flash drives you purchase will often come formatted with FAT32 for maximum compatibility across not just modern computers, but other devices like game consoles and anything with a USB port.

Limitations come with that age, however. Individual files on a FAT32

drive can’t be over 4 GB in size—that’s the maximum. A FAT32 partition

must also be less than 8 TB, which admittedly is less of a limitation

unless you’re using super-high-capacity drives.

While FAT32 is okay for USB flash drives and other external

media—especially if you know you’ll be using them on anything other than

Windows PCs—you won’t want to FAT32 for an internal drive. It lacks the

permissions and other security features built into the more modern NTFS

file system. Also, modern versions of Windows can no longer be

installed to a drive formatted with FAT32; they must be installed to

drives formatted with NTFS.

Compatibility: Works with all versions of Windows, Mac, Linux, game consoles, and practically anything with a USB port.

Limits: 4 GB maximum file size, 8 TB maximum partition size.

Ideal Use: Use it on removable drives where you need

maximum compatibility with the widest range of devices, assuming you

don’t have any files 4 GB or larger in size.

Extended File Allocation Table (exFAT)

The exFAT file system was introduced in 2006 and was added to older

versions of Windows with updates to Windows XP and Windows Vista. exFAT

is optimized for flash drives—designed

to be a lightweight file system like FAT32, but without the extra

features and over head of NTFS and without the limitations of FAT32.

Like NTFS, exFAT has very large limits on file and partition sizes.,

allowing you to store files much larger than the 4 GB allowed by FAT32.

While exFAT doesn’t quite match FAT32’s compatibility, it is more

widely-compatible than NTFS. While Mac OS X includes only read-only

support for NTFS, Macs offer full read-write support for exFAT. exFAT

drives can be accessed on Linux by installing the appropriate software.

Devices can be a bit of a mixed bag. The PlayStation 4 supports exFAT;

the PlayStation 3 does not. The Xbox One supports it, but the Xbox 360

does not.

Compatibility: Works with all versions of Windows and modern

versions of Mac OS X, but requires additional software on Linux. More

devices support exFAT than support NTFS, but some—particularly older

ones—may only support FAT32.

Limits: No realistic file-size or partition-size limits.

Ideal Use: Use it when you need bigger file size and

partition limits than FAT32 offers and when you need more compatibility

than NTFS offers. Assuming that every device you want to use the drive

with supports exFAT, you should format your device with exFAT instead of

FAT32.

NTFS is ideal for internal drives, while exFAT is generally ideal for

flash drives. However, you may sometimes need to format an external

drive with FAT32 if exFAT isn’t supported on a device you need to use it

with.

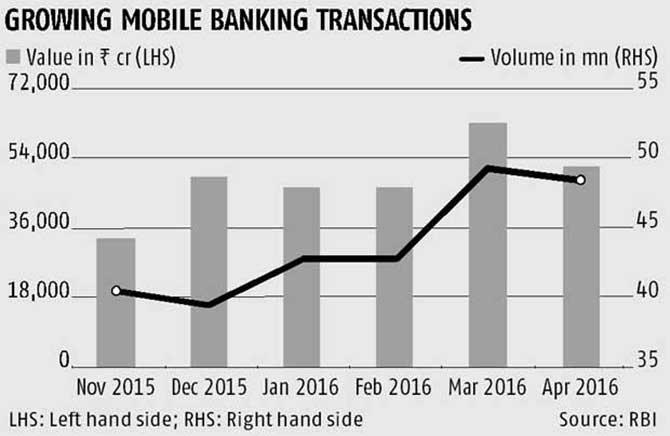

Banking on feature phones: India has over a billion mobile connections.

Banking on feature phones: India has over a billion mobile connections.